Half Share Transfers

“How Can I Get My Partner’s Name Off My Title Deed?”

This is what conveyancers are most frequently asked.

There is frequently the need to change, cancel or undo the common practice of co-ownership or owning immovable property together or jointly with another.

What Is Involved In Transferring A Half Share (Or Any Share) In A Piece Of Land?

Co-ownership and Joint ownership mean the same thing and these words are used interchangeably. There are many articles about the nature of co-ownership or owning property jointly; but none of them explain the complicated and costly process of cancelling that original joint ownership arrangement.

Frequently the circumstances and relationships between the erstwhile co-owners change over time and they subsequently decide to undo or cancel that original co-ownership.

This frequently results in the need to transfer away, the former share of ownership to the other partner; who will become the full and sole owner, of the whole property.

Alternatively, both original co-owners may decide to sell and transfer each of their shares in the land to an independent third party.

Most people do not realise that the process amounts to a full-blown property transfer; which quite often is more complicated than the original process of buying the property. It is simply not possible to “just delete a name off a title deed”.

Even the transfer of a half share in a property, requires the payment of advance rates and taxes, advance homeowner’s association levies, advance sectional title levies, mortgage bond cancellation costs and mortgage bond re-registration costs, and transfer fees to the conveyancer. All of which must be paid before the documents can be lodged in the Deeds Office. The conveyancer’s job is to collect and reconcile all these payments from the owner/s.

What About Transfer Duties?

Transfer duty is also payable by the transferee/purchaser; unless otherwise exempted. This is because the acquisition of a share in the property is deemed to be an acquisition of ownership in immovable property by The Transfer Duty Act. So an acquisition tax (transfer duty) is to be paid on the acquisition of even a half share in a property and the conveyancer becomes the tax collector. He has to, in turn, pay the tax over to The Receiver of Revenue, using dedicated online software.

The conveyancer will be required to lodge in The Deeds Office, the various rates and taxes/levy clearance certificates as well as the Transfer Duty Receipt or Transfer Duty Exemption Receipts. The Alienation of Land Act as well as the Receiver of Revenue require a sale or a disposal agreement in writing, signed by both parties; without which, the disposal of the share in the property will be invalid.

Reconciling Finances

Negotiations between the joint owners can be complicated and are always unique to their particular circumstances. If the bank does not agree to the transferee “taking over the existing bond”, the co-owners will have to agree to cancel the bond first and they might have to raise new funds from a new bond to pay off the first bond.

If they agree to sell the whole property to a third party, they would typically use the purchase price to pay off the existing bond to zero and to also pay the estate agent’s selling commission. So only the nett proceeds would be split between the parties. The conveyancer would arrange these payments.

Attorney Fees

There will be transfer costs which incudes the attorneys fee and Transfer Duty if not exempted.

A conveyancer’s fee is based on the market value of the property, in terms of industry recognised guidelines.

For a half share transfer where the Conveyancer is only transferring half of the property, the attorney’s fees are calculated on the market value of the half share. If the whole property is valued at R 1 000 000,00 then the transfer fees are calculated on the lesser value of R 500 000,00.

The first step is to obtain two estate agents’ valuations (which must be on an estate agent’s letterhead and signed by the estate agent before SARS will accept them). The fees and Transfer Duties are calculated on the current market value of the whole property. Invariably the Receiver chooses the highest valuation upon which to calculate the transfer duty.

Transfer Duty Calculations

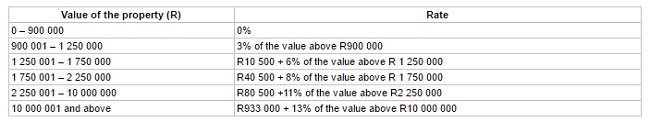

The transfer duty tables can be found on the SARS website.

If the whole value of the property is less than R900 000 on property acquired on or after March 2017); then transfer duty is exempt and no transfer duty is payable.

However, if whole property is valued at more than R900 000 on property acquired on or after March 2017), then transfer duty is payable. There is a two-step process in calculating the amount.

Firstly, one takes the combined value of the shares in the whole property in order to ascertain the transfer duty applicable; as if the whole property is sold.

Secondly, the transfer duty for the value of the whole property is divided in half, to arrive at the transfer duty for the acquisition of a half share in the ownership. The exact formula is contained in Section 2 of the Transfer Duty Act.

Current Transfer Duty Rates For Property Acquired On Or After 1 March 2017

When Is The Transfer Duty Exempt?

If the property is to be transferred in terms of a High Court Divorce Order or a Will, then the transfer duty is completely exempt.

Examples Of The Transfer Costs – (at the time this article is written)

• For a Half share valued at R500,000.00, the Transfer Costs will total R 16,239.67: – (Transfer Duty of R1,500.00 and Fees of R14,738.67);

• For a Half share valued at R417,750, 00, the Transfer Costs will total R 12,842.11: – ( Transfer Duty exempt and Fees of R 12,842.11.

Existing Mortgage Bonds

Most banks will allow the incoming purchaser of a half share to take over the existing mortgage bond debt of the seller. This called a Section 57 Substitution of Debtor.

The first step will be to submit an application to the bank for a Credit Approval, for what is called a “substitution of the (outgoing) debtor”, under the mortgage bond. Once the bank has received an application for a substitution of debtor, it will do a credit check to ensure that the person taking over the property, is able to afford paying the whole bond. Once this is approved, the bank will forward an instruction along with the original title deed to a conveyancing attorney on their panel to attend to the substitution at the Deeds Office. The Substitution is done by the Registrar of Deeds signing an endorsement note on the mortgage bond.

The conveyancer is expected to charge a conveyancing fee to draft and register the substitution in the Deeds Office.

Conclusion

Before embarking on a transfer, one should speak to a specialist to find out how to structure the transaction and also the financial implications and as well as all the costs.

Need help with half share transfers?

At Denoon Sampson Ndlovu, we ensure that smooth property transfer processes take place.

Fast forward your property transfer by avoiding potentially costly pitfalls with hands on conveyancing attorneys.